5 Cryptos I’m Buying in the New Altcoin Season

Welcome to another Crypto Weekly Digest brought to you by VirtualBacon.

This week we’ll be diving into the much-anticipated new altcoin season. With Bitcoin's recent surge past the $35,000 mark, now somewhat stabilizing, we're noticing an intriguing shift. Bitcoin's dominance rocketed but is now steadying, hinting that it's altcoins' time to shine. As Bitcoin hovers, investors are eyeing the altcoin market, where short-term gains look promising. I'm gearing up to capitalize on this momentum by focusing on altcoins that have demonstrated robust performance in the year's first half. We'll delve into why these altcoins are prime picks for buying on dips and how they could shape your investment strategy in the weeks to come. As with every week, we'll conclude with a snapshot of market movements and pivotal project developments that have surfaced.

Crypto Money Flow

If you're somewhat new to crypto, you might not be familiar with the typical flow of money within the market. Credit to Rekt Capital, whose insights on YouTube and a 2020 chart explain this well.

Money in crypto usually starts with fresh investment from fiat to Bitcoin, like we've recently observed. Once Bitcoin begins to stabilize after its surge, this capital starts trickling down into various altcoin categories – from large to mid, then small caps. After each rally has peaked, there's a market reset. Investors return to Bitcoin, seeking profits before the cycle recommences. Presently, as Bitcoin moves sideways, many are transferring their Bitcoin earnings into altcoins. We'll break down some standout altcoins, particularly why they're attractive right now.

Solana

Solana's potential to revisit its all-time high of $250, with a $62 billion market cap, is now seen as realistic, elevating its status within the top five coins. Conservative estimates place it between $78 to $136, reflecting a $65 billion market cap, feasible for top 10 coins in bull markets. Despite recent gains, the expectation is not immediate; patience is advised for a short-term correction, with ideal entry points for Solana between $27 to $32.

The recent Solana Breakpoint conference could affect prices, indicating a 'sell the news' event may follow, providing a potential buying opportunity. Long-term predictions until 2025 suggest significant growth, but current focus is on near-term opportunities without fear of missing out, as market trends show that prices don't always go up in a straight line and don't keep going up forever.

Polygon

Polygon is gearing up for a big change with its Polygon 2.0 update, transitioning from MATIC to POLE. This update revamps the token's role across multiple Ethereum Layer 2 solutions, solidifying POLE as a key staking token.

In terms of trading, Polygon shows a clearer path compared to Solana. It has recently broken a key downward resistance, hinting at a new support level. A noticeable double bottom pattern formed in August and September, with a significant rise in price following the neckline breach.

The current attractive entry range for MATIC lies between $0.057 and $0.059. This zone combines the recent breakout point and the double bottom neckline, offering a strategic position for traders. With only a 6% potential drop from its current level and the exciting Polygon 2.0 launch, MATIC presents an interesting opportunity for investment.

Avalanche

Avalanche's chart shows potential. With a peak from its all-time high at $150, it faced significant diagonal resistance throughout the bear market. Recently, there’s a hint of breaking above this resistance, but it’s too soon to confirm a clear breakout. Another crucial factor is the neckline of a double bottom pattern around $10.70, mirroring the pattern observed in Polygon's chart. These two critical levels converge at $10.70, making it a compelling trade setup.

For a more assured entry, I’d wait for Avalanche to stabilize above this level, possibly around $11 to $12, solidifying the breakout. Subsequent dips back to around $10.70 would offer a prime long entry, as this level is likely to turn into strong support. Given its status as a prominent Ethereum alternative, Avalanche remains an intriguing asset to watch, particularly if it sustains above $10.70 this month.

Chainlink

Chainlink has just burst out of a long quiet spell that's lasted a year and a half. The price is inching up slowly, which makes finding a good spot to jump in pretty tricky. You risk buying in, only to see it dip down for a quick retest of lower prices, maybe around $8 or $9. I'm watching Chainlink closely but haven't positioned myself just yet because it's tough to call the shots with how it's moving right now.

However, if it drops back to anywhere between $8.20 and $9, I'd be all over that. It'd be a strong sign to buy, considering how solid that level has been over the last 18 months. It's hard to say if we see that play out, but if it comes, it's a no-brainer trade. So, I've got Chainlink on my radar and am crossing my fingers for that drop.

Injective

Injective has been on a tear this year, outshining all other coins with a staggering 10x gain from January to now. It defied the odds by not dipping when other alts stumbled, and after a steady April peak, it held strong, only to climb higher. Recently, it notched up another 70% in just two weeks. This strength is something to watch. Rather than bet against it because it's soared, the smart move in this bullish market is to pick it up on any dips.

For Injective, $9.40 is a key price — it's been a peak point in both April and July. If it dips to that sweet spot, it’s a prime buying opportunity, although it’s a long shot given its current momentum. Short-term traders should eye the $11.60 to $12.60 zone for a quick play, with a stop loss around $11.20 to $11.30 for safety. If you catch it at an average of $12, that’s a solid trade with clear boundaries set for risk and reward.

Altcoin Market and Project Updates

Now, let's check out the major altcoin gainers and losers from the past week, and catch up on key project updates.

Best Performing Coins of The Week

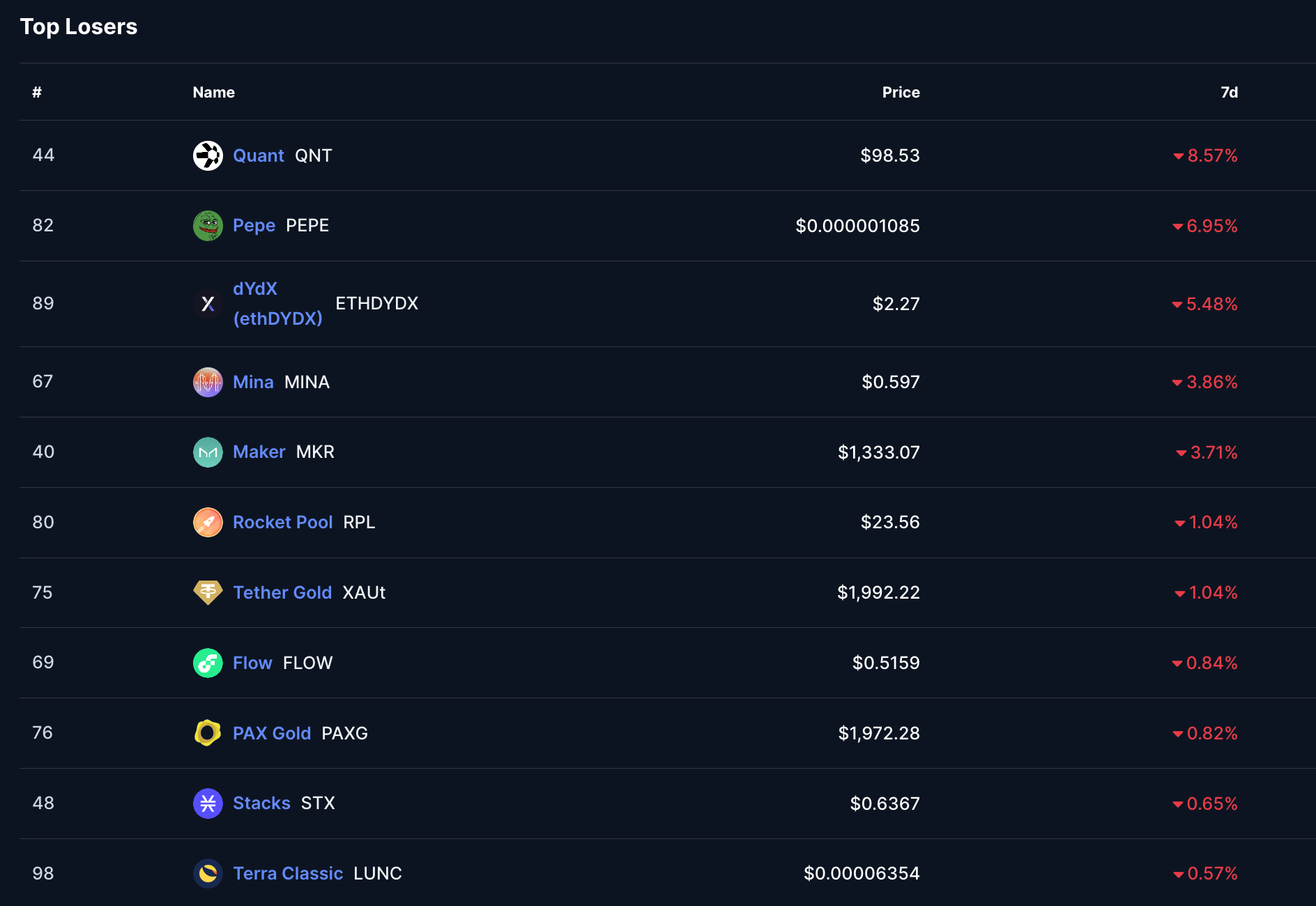

Worst Performing Coins of The Week

🟠 SEC investigates PayPal's PYUSD stablecoin, launched in August for digital payments.

https://cointelegraph.com/news/paypal-subpoena-sec-pyusd-stablecoin

🟠 Worldcoin Wallet hits 1M monthly users, 4M downloads, 22M transactions, ranking 6th globally.

https://worldcoin.org/blog/announcements/world-app-tops-4-million-downloads-active-users-double

🟠 MetaMask introduces new security alert feature with Blockaid to protect users against crypto scams and hacking.

https://decrypt.co/203803/metamask-launches-new-security-alerts-feature-blockaid

🟠 Uniswap Foundation moved 9.8 million UNI tokens, worth around $40.66 million, to various exchanges in recent days.

🟠 Terraform Labs seeks court dismissal of SEC's fraud case, claiming insufficient evidence after a $40 billion crash.

🟠 Starknet Foundation allocates 50M STRK tokens to early supporters, with availability set for April 15, 2024, excluding U.S. citizens.

🟠 Celestia's $TIA token launches on exchanges like Binance; mainnet live with 60M tokens airdropped, backed by $56.5M funds.

http://binance.com/en/support/articles/4492f05f8b0e40f2a6dc9321aba0ba27

🟠 Unibot trading bot faced a token approval exploit; attacker laundered 355.75 ETH ($640k) via Tornado Cash.

https://twitter.com/TeamUnibot/status/1719239188514844735

🟠 SEC arrests SafeMoon founders for fraud, SEC charges for misusing millions in investor funds.

https://watcher.guru/news/us-government-arrests-founders-of-safemoon-crypto-token

🟠 $TON blockchain sets record with over 42M transactions in 12 mins, averaging 108,409 TPS.

https://x.com/CryptoMiners_Co/status/1719577454266728873?s=20

This week, we zoomed in on the top 5 altcoins to watch as altseason approaches, highlighting Chainlink's breakout and Injective's staggering 10x rise this year as standouts. We delved into the market movements, offering strategic insights for potential entry points and cautionary notes on the challenging trading landscape. As always, we also checked out the biggest winners and losers in the altcoin world, plus all the must-know project updates over the course of the past week.

New Videos

I Was Wrong about Solana (Price Prediction Update)

Top 3 Cryptos to Buy in November (AI Edition)

Top Cryptos I'm Buying in the New Altcoin Season

Is GALA Finally Worth Buying? NEW Bull Run Potential!

Friend Tech Is a "High Yield" DeFi Farm

Why is Bitcoin Pumping? Is BlackRock Really Buying?

End

Thanks for reading! If you enjoyed this newsletter, please share it with your friends.

Also check out Fairdesk Exchange - Leading Global Crypto Exchange with no KYC requirements.

I have set up a VirtualBacon copy-trading account on Fairdesk that you can use to follow all my trades.

If you sign up with my link, you can get a special signup bonus of upto $100,000 USD based on how much you deposit.