My Top Picks in the Web3 Gaming Sector

Welcome to another Crypto Weekly Digest brought to you by VirtualBacon.

This week we’ll be exploring Web3 gaming's potential. After extensive research, I'm spotlighting my top five crypto gaming projects. The gaming and metaverse space have always sparked interest within the crypto community. Despite the highs and lows in the last bull market, the mixture of gaming with NFT asset tokenization stands out as a game-changer. As we expect technology and adoption to align in the next cycle, it's essential to look beyond the prevailing NFT skepticism and embrace the immense prospects ahead. As with every week, we'll conclude with a snapshot of market movements and pivotal project developments that have surfaced.

The Challenge of AAA Crypto Games

The crypto gaming sector is poised for growth, but investing solely in individual games is risky. Many games will inevitably fail, mirroring typical game development trends. True AAA crypto games require substantial time (often 5+ years) and funding (around $30-$40 million), yet the crypto market's impatient nature seeks quicker returns. This mismatch creates a problem: while the crypto bull market cycles roughly every four years, AAA game development surpasses this period. Therefore, betting on crypto gaming infrastructure projects might be safer. They're resilient, adaptable, and cost-efficient, especially during market downturns, making them a more stable investment compared to high-end games.

Layer 1 Gaming Blockchains

Diving into the world of gaming blockchains, there's a unique set of Layer 1 projects specifically tailored for gaming. While Enjin coin is well-known, there’s much more beneath the surface. Enjin, Wax, Ronin, Ultra, and WeMix all offer fast, low-cost solutions for game developers to mint NFTs and assets, there's a catch. These chains use their technology, so any game built on them remains in their ecosystem, limiting access to renowned blockchains like Ethereum or Layer 2 systems. Although few AAA games opt for these alternative Layer 1s, these blockchains have substantial treasuries from past bull markets, aiding their survival and ensuring their presence in the crypto gaming future. Now, let's delve deeper and explore each of these coins more specifically.

Enjin

Enjin might be familiar to many, but there's a significant update on the horizon. While it currently boasts a token supply of 1 billion, with all of it circulating, Enjin is gearing up for a game-changer: their token migration.

https://enjin.io/blog/welcome-enjin-blockchain

They're launching the Matrix chain, transitioning from Ethereum to their independent layer one. With this, not only will the Enjin token undergo a 1:1 migration, but the total supply will jump to 1.75 billion. This includes the integration of their Infinity token and an additional 250 million tokens. Consequently, this will shift the market cap considerably. Still, with its longstanding presence since 2017, Enjin remains a noteworthy contender in the market.

WAX

WAX, trading since 2018, boasts solid tokenomics with 3.3 billion of its 3.7 billion token supply already in circulation. However, while it has 90% of its tokens already active, there's a key aspect to consider. WAX is founded on the older EOS infrastructure. It initially used EOS as a foundational network, which might deter newer games from integrating with them. So, despite its good tokenomic track record, its underlying technology could be a limiting factor.

Ultra

Ultra, despite trading since 2019, raises eyebrows with its tokenomics. Valued at $50 million in market cap, only 35% of its 1 billion token supply is circulating, which is unusual given its four years in the market. Like WAX, Ultra's foundation is on the older EOS infrastructure. This combined with its puzzling token circulation makes it less appealing, despite its low valuation. Investors should approach with caution.

Ronin

Ronin, developed by Sky Mavis - the brains behind the breakout game, Axie Infinity - has a significant backing.

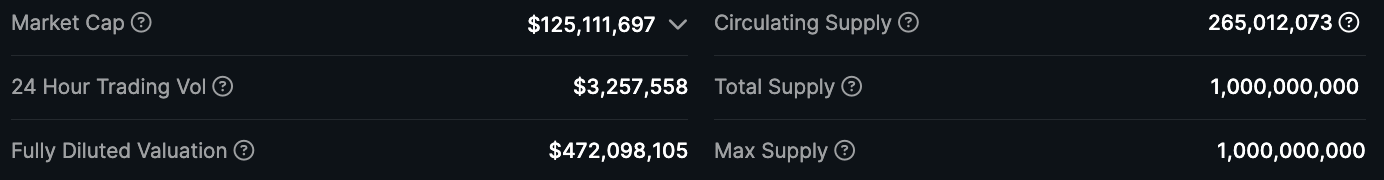

They flourished in the bull market, ensuring a robust treasury to weather any downturns. However, its tokenomics raise concerns. From its 1 billion token supply, only 25% is circulating, which is surprising given Sky Mavis's financial strength. While its market cap of $100 million seems reasonable, potential investors should remain cautious due to the not-so-appealing tokenomics.

WeMix

WeMix might not ring a bell if you're from North America, but it's a heavy hitter in the Korean market. Made by "WeMade", a prominent publicly traded Korean company, they're the masterminds behind the renowned MMO, "Mir M", spanning four versions. Another feather in their cap is "Riders of Icarus", a popular MMO on Steam. With their strong background, WeMix is definitely worth noting. Their tokenomics? A bit disappointing, with only 30% of total supply in circulation. When assessing tech, unlike older blockchains like WAX and Ultra based on EOS, or even Enjin's non-EVM compatible upcoming chain, WeMix supports Ethereum Virtual Machine compatibility. This edge suggests potential for significant adoption in upcoming cycles.

Alright, that wraps up our top five Layer 1 gaming blockchains. If you're keen on diving into this category, consider dividing your investments among these options. I don't particularly favor one over the others, so it's up to you to make your pick!

Layer 2 Gaming Blockchains

Transitioning from Layer 1, let's delve into Layer 2 gaming blockchains. There are only a handful of Layer 2s truly worth our attention, so let's dive right in and uncover them.

ImmutableX

IMX stands out as the leading gaming-focused layer 2 that's Ethereum-compatible. While layer twos are anticipated to outpace layer ones in the next cycle due to their alignment with Ethereum, IMX has uniquely positioned itself to fully support gaming from its start.

It offers two key solutions: the original Immutable X layer 2, focusing on NFT trading for games, and the more recent IMX EVM, a cutting-edge ZK rollup fully compatible with Ethereum and tailored for gaming.

https://www.immutable.com/products/immutable-zkevm

Despite their technical strengths, IMX's actual game adoption leans more towards crypto-native titles, with major traditional gaming partnerships still in early stages. Market-wise, IMX's token valuation stands at under $700 million, with 1.2 billion tokens circulating from a total supply of 2 billion, indicating strong tokenomics.

With a nimble approach and adaptability, IMX seems poised to remain a pivotal player in gaming layer 2 solutions, making it a worthy consideration for the next cycle.

Merit Circle

Merit Circle notably undergoing a rebrand, this project originally surged during the Play-to-Earn gaming boom alongside giants like Axie Infinity.

Launching as a gaming guild, they've morphed significantly. They transitioned into an investment DAO, strategically putting their earnings back into diverse crypto games. Today, Merit Circle is pivoting once more, introducing 'Beam' - a gaming blockchain designed in partnership with Avalanche.

Why Avalanche? Merit Circle's sharp treasury management in the bear market showcased their financial power. Their treasury, since late 2021, impressively hovers around $100 million, testament to their fiscal responsibility.

Breaking down the numbers: a $166 million market cap, approximately $94 million in the DAO's treasury, and a reported annual earning of $6 million paints a promising picture for potential investors. Their forthcoming rebranding as 'Beam' aligns them as a standout in the gaming Layer 2 space, placing them directly in competition with Immutable X. The tokenomics, featuring a sizable cash reserve relative to market cap, makes Merit Circle (soon-to-be Beam) an appealing bet for the next cycle.

Gala

Moving on from Layer 2s, we spotlight Gala Games - a name most are familiar with. Once skeptical due to its inflated tokenomics during the 2020-2021 bull market, I've changed my stance. Gala Games, similar to a "Steam" for web 3 games, boasts sectors like music, film, and gaming, all underpinned by the Gala token and ecosystem nodes.

In the previous bull run, Gala's attraction was high returns. Its market cap soared to over $5 billion, but with only 14% of total tokens circulating, this inflated the price. Early node providers profited immensely, but the model's sustainability was doubtful.

Today's landscape is different. Of an initial 50 billion tokens, 20.9 billion were burnt, capping the supply at 29 billion. With 25 billion in circulation, 2 billion with the Gala team, and the remainder releasing by 2030, inflation is on a steady decline.

Improved tokenomics reduce the risk of market dumps. With its previous challenges rectified, Gala presents a compelling investment prospect.

Honorable Mentions

Before diving into my top crypto gaming picks, let's address some honorable mentions. These are projects that have garnered attention but, in my view, might not live up to the gaming hype.

Veracity

Veracity used to be in the gaming space, but its focus has now pivoted. Its main feature, the VeraView advertising stack, aligns it more with platforms like Brave browser and the Basic Attention Token. Even though Veracity's popularity continues, it shouldn’t be labeled as a gaming coin anymore.

GameSwift

GameSwift, a newer entry, has constructed an ecosystem centered on crypto-native games. They've developed their blockchain, SDK, and studio. While the infrastructure is commendable, the platform lacks traction with popular AAA games, limiting its appeal to mainstream gamers.

Games for a Living

Many applaud GFAL for its coin's impressive price performance. Yet, a closer inspection reveals a lack of originality in their game offerings, with titles that seem copied or hastily made. Despite the financial success, I'm skeptical of their genuine commitment to gaming.

Vulcan Forged

Once a popular name in gaming circles, Vulcan Forged's coin hasn't seen the same enthusiasm lately. The announcement of their Elysium blockchain didn't reignite my interest, given my reservations about such closed ecosystems in the gaming world.

Magic

Magic Treasure DAA stood out in the bull market. Their angle is being an onchain game studio and publisher, emphasizing play-to-earn models, gamified farming, and NFT collecting. However, the overall momentum for onchain gaming seems to have died, making me less optimistic about its future.

Echelon Prime

Echelon Prime is behind the Parallel card game, which introduced a number of NFTs with potential earnings. It continues the onchain gaming narrative of using NFTs to farm game tokens. Though it's noteworthy, I'm not particularly bullish about this approach.

These projects have their merits, but as the crypto gaming sector evolves, it's essential to distinguish genuine gaming potential from mere hype.

Top Pick: Ready Games

Let's talk about my top pick: Ready Games.

I've mentioned it before, and it truly stands out. Why? Ready Games is a leader in making web 3 games. It works well with the major blockchains and fits perfectly with popular game-making tools like Unity and Unreal. The best part? If you're a game developer, Ready Games makes it easy to get your web 3 games on platforms like iOS and Android.

What makes Ready Games special? While many gaming projects are making things that don't really help the gaming community, Ready Games is different. They're not just making their own games; they're helping popular web 2 games shift to web 3. In the last year alone, they've worked with over 100 game makers, including big names like Cimu Games.

https://egamers.io/cimu-games-integrates-ready-games-tech-to-re-release-runestone-keeper/

And here's something cool: Ready Games is introducing a new in-game currency called $RDYX.

https://ready.gg/readyx-token/

It's set to be used in many games, which is exciting. I'm eager to see how it'll change gaming. Among all the gaming projects out there, Ready Games truly shines the brightest. If you're into games or thinking of investing, it's worth checking out. So, dive in and see what Ready Games has to offer!

Altcoin Market and Project Updates

Now, let's check out the major altcoin gainers and losers from the past week, and catch up on key project updates.

Best Performing Coins of The Week

Worst Performing Coins of The Week

🟠 dYdX Chain to give all fees to validators and stakers; trading fees paid in USDC. Alpha mainnet launched, V4 enhancements highlighted.

🟠 Neo is creating a sidechain for Ethereum dapp support and N3 mainnet interoperability. Testnet expected by year's end, with mainnet to follow.

https://www.theblock.co/post/259741/neo-plans-ethereum-compatibility-via-sidechain

🟠 Ethereum's Dencun upgrade set to go live in Q1 2024. Upgrade is to enhance storage, cut fees, and reduce rollup transaction costs.

🟠 After a 280 ETH exploit, Telegram bot Maestro refunded users 610 ETH, covering all losses. Some users received more than their lost amount.

https://cointelegraph.com/news/telegram-maestro-bot-610-ether-refund

🟠 dYdX open-sources v4 code, transitioning to Cosmos SDK. Fully decentralized chain redirects fees to stakers. Mainnet launch imminent.

https://blockworks.co/news/dydx-ethereum-open-source

🟠 Chainlink's Staking v0.2 to launch: Features unbonding, liquid rewards, stake slashing for nodes, modular architecture, dynamic rewards, and priority migration for v0.1 stakers.

https://x.com/chainlinkgod/status/1716266733366030664

🟠 Worldcoin will stop paying Orb Operators in USDC, opting for its native WLD token from November, affecting most jurisdictions.

https://cointelegraph.com/news/worldcoin-cease-usdc-payments-native-token-wld

🟠 CelestiaOrg's mainnet goes live on 31st October; airdropped coins will auto-appear in wallets post-launch.

https://x.com/EthExploring/status/1715709698417348717?s=20

🟠 On Oct 24, PEPE team burned 6.9 trillion tokens ($6.76M). Post-burn, their address holds 3.79 trillion tokens ($3.72M). PEPE's value rose by 80% in 7 days.

https://twitter.com/EmberCN/status/1716607498491502611?s=20

🟠 On Oct 27, Binance revealed the 39th phase, featuring Memecoin (MEME) for mining. It lists on Nov 3.

In this week's newsletter, we delve deep into the growing space of crypto gaming, highlighting key projects across five different sectors. Our focus is on projects that not only promise real adoption but also possess the resilience to weather bear markets. As we zoom into the alternative layers dedicated to gaming, it's clear some are primed for the next hype wave. A notable mention goes to Ready Games, a standout project converting Web 2 players to Web 3. It's crucial to do your own research on the mentioned games to verify their authenticity. As always, we also checked out the biggest winners and losers in the altcoin world, plus all the must-know project updates over the course of the past week.

New Videos

Top Cryptos I'm Buying in the New Altcoin Season

Is GALA Finally Worth Buying? NEW Bull Run Potential!

Friend Tech Is a "High Yield" DeFi Farm

Why is Bitcoin Pumping? Is BlackRock Really Buying?

End

Thanks for reading! If you enjoyed this newsletter, please share it with your friends.

Also check out Fairdesk Exchange - Leading Global Crypto Exchange with no KYC requirements.

I have set up a VirtualBacon copy-trading account on Fairdesk that you can use to follow all my trades.

If you sign up with my link, you can get a special signup bonus of upto $100,000 USD based on how much you deposit.